43 math worksheets calculating sales tax

'I Couldn't Do Math, a Surprising Diagnosis Revealed Why' Tips, taxes, time. All of this requires math. Now, I am determined to make it as a writer and thrive in academia by pursuing my passion for literature, rather than focus solely on my deficits in ... Tax Calculators - Marylandtaxes.gov If you have any questions, please contact our Collection Section at 410-260-7966. Estimated Payment Calculators. Quarterly Estimated Tax Calculator - Tax Year 2022. Use this calculator to determine the amount of estimated tax due for 2022. Quarterly Estimated Tax Calculator - Tax Year 2021.

What is the 28 percent rate gain worksheet? - Vivu.tv Two categories of capital gains are subject to the 28 percent rate: small business stock and collectibles. If you realized a gain from qualified small business stock that you held for more than five years, you generally can exclude one-half of your gain from income. The remaining gain is taxed at a 28 percent rate.

Math worksheets calculating sales tax

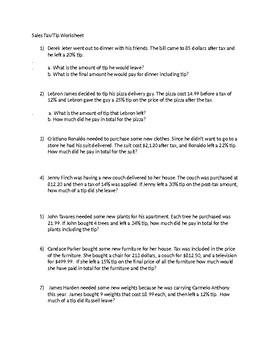

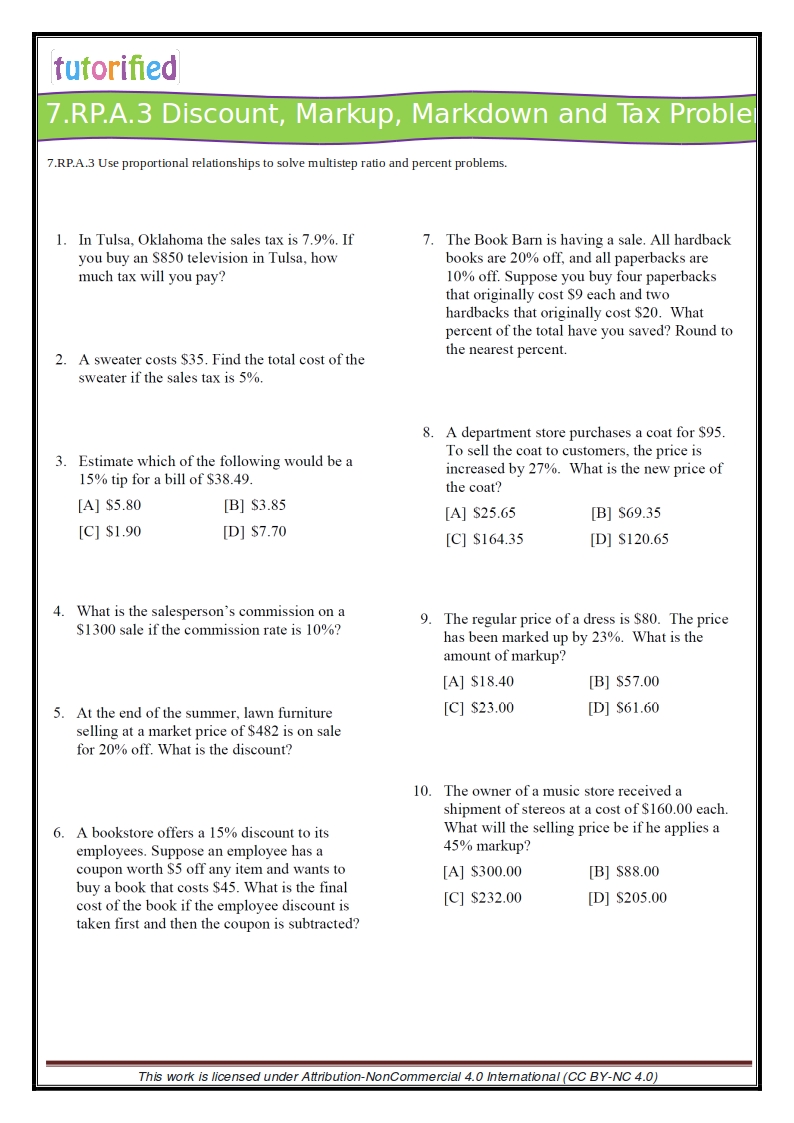

Mr. Grunenwald's Website || 7th Grade Math - NYLearns Monday (11/17) - Introduction to Percentages, Homework #'s 1 & 2 on worksheet (Last page of posted notes) NO Weekly Assignment this week. Weekly Assignment 8 will be due Wednesday Nov 26th. If you will not be in school please make sure to hand it in on Tuesday 7R 11-17 Notes.pdf. Tuesday (11/18) - Sales Tax and Discount, Homework - Worksheet Proportion Math Problems, Solutions and Explanations The sales tax on a $1,000 purchase can be found by solving this proportion: 100x = 6,400 (100x) ÷ 100 = 6,400 ÷ 100. x = 64 ... Creating Your Own Math Problems and Worksheets Supplementing your child's math lessons with a few problems and worksheets of your own will help you become better acquainted with his or her curriculum, and will help ... Percents - calculate tax, tip, mark-up, and more Sixth grade Math ... Percents - calculate tax, tip, mark-up, and more Sixth grade Math Worksheets. September 15, 2022 by ppt. Get free questions on "Percents" to improve your math understanding. These worksheets are perfect for sixth grade math students. Categories Math, Sixth grade Post navigation. Find the number of each type of coin Sixth grade Math ...

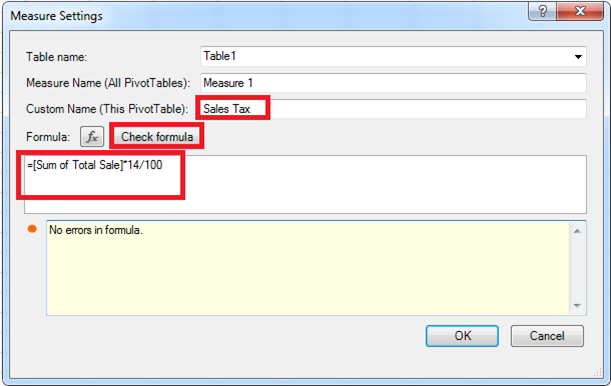

Math worksheets calculating sales tax. Sales tax and tip calculator - KamalThumbiko Sales tax and tip calculator. Texas has a 625 statewide sales tax rate but also. The 1 Tip and Discount Calculator for iPhone and iPad with extended features. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. The calculator will show you the total sales tax amount as well as the county city. Accounting Fundamentals Series - ed2go This course will build on the knowledge you gained in Accounting Fundamentals, to provide you with a solid understanding of corporate accounting practices. You'll explore such topics as special journals, uncollectible accounts receivable, plant assets, depreciation, notes and interest, accrued revenue and expenses, dividends, retained earnings ... 2022 2023 Tax Brackets, Standard Deduction, 0% Capital Gains, etc. The maximum zero rate amount cutoff is $83,350. $13,350 of the qualified dividends and long-term capital gains ($83,350 - $70,000) is taxed at 0%. The remaining $20,000 - $13,350 = $6,650 is taxed at 15%. A similar threshold exists on the upper end for qualified dividends and long-term capital gains. DAX overview - DAX | Microsoft Docs Total Sales = SUM( [Sales Amount]) When a user places the TotalSales measure in a report, and then places the Product Category column from a Product table into Filters, the sum of Sales Amount is calculated and displayed for each product category. Unlike calculated columns, the syntax for a measure includes the measure's name preceding the formula.

Calculate Percentages | A Step-by-Step Guide for Students At what percentage was his total purchase taxed? Solutions 1. The fraction is 18/20, and 20 is a factor of 100, so you can write 18/20 as the equivalent fraction 90/100 (20 x 5 = 100 and 18 x 5 = 90). This means that Andrew got 90% of the questions on his test correct. 2. Sonja did jumping jacks for six out of 15 minutes, so the fraction is 6/15. Divide money amounts Sixth grade Math Worksheets Divide money amounts Sixth grade Math Worksheets. Percents - calculate tax, tip, mark-up, and more Sixth grade Math Worksheets. Find the number of each type of coin Sixth grade Math Worksheets. Add and subtract money amounts: word problems Sixth grade Math Worksheets. Convert between Celsius and Fahrenheit Sixth grade Math Worksheets. FAQs About Income Tax - Marylandtaxes.gov Taxpayer Support You can contact us at: (410) 260-7980 or (800) 638-2937 or e-mail at taxhelp@marylandtaxes.gov Disclaimers We cannot be responsible for inaccurate printing due to variations in hardware or system settings. You should check your printed copies for completeness before you leave the tax confirmation page. Additional copies Discount and markup calculator - TariqEden Percent Discount and Tax Calculator. To find markup in dollars simply substract the cost from selling price. 45 450 4050. ... Percents Sales Tax Tips And Commission Notes Task Cards And Worksheet Retail Markup Calculator Markup Pricing Formula Excel Margin Formula ... Markup Calculator Math Calculator Calculator How To Find Out

Sales and Use Tax - Marylandtaxes.gov By statute, the 6% sales and use tax is imposed on a bracketed basis. The amount of tax due is determined by the sale price in relation to the statutorily imposed brackets. The amount of tax increases one cent from one bracket to the next with 6 cents due on each exact dollar. The 9% sales and use tax is a flat rate. Accounting with QuickBooks Online Suite - ed2go Accounting with QuickBooks Online Suite. This comprehensive course will teach you the basics of accounting with QuickBooks Online, the most widely used accounting software for small business owners. You'll master the basics double-entry bookkeeping and get hands-on experience handling accounts receivable, accounts payable, sales taxes and other ... EOF Estimated Tax Payments Are Due Today. Who Needs to File, How to Submit ... There are a few ways to calculate your quarterly tax payments depending on your business model and annual earnings. If you earn a steady income, estimate the tax you'll owe for the year and send...

Business day counter - GordonEmmi 4 Free Math Worksheets Second Grade 2 Counting Money Counting Money Canadian Nickels Dimes Qu Balance Sheet Template Counting Worksheets Sales Report Template Business Days Calculator Use this working days calculator to easily calculate the number of business days excluding weekends between any two given dates or to add business days.

Percents - calculate tax, tip, mark-up, and more Sixth grade Math ... Percents - calculate tax, tip, mark-up, and more Sixth grade Math Worksheets. September 15, 2022 by ppt. Get free questions on "Percents" to improve your math understanding. These worksheets are perfect for sixth grade math students. Categories Math, Sixth grade Post navigation. Find the number of each type of coin Sixth grade Math ...

Proportion Math Problems, Solutions and Explanations The sales tax on a $1,000 purchase can be found by solving this proportion: 100x = 6,400 (100x) ÷ 100 = 6,400 ÷ 100. x = 64 ... Creating Your Own Math Problems and Worksheets Supplementing your child's math lessons with a few problems and worksheets of your own will help you become better acquainted with his or her curriculum, and will help ...

Mr. Grunenwald's Website || 7th Grade Math - NYLearns Monday (11/17) - Introduction to Percentages, Homework #'s 1 & 2 on worksheet (Last page of posted notes) NO Weekly Assignment this week. Weekly Assignment 8 will be due Wednesday Nov 26th. If you will not be in school please make sure to hand it in on Tuesday 7R 11-17 Notes.pdf. Tuesday (11/18) - Sales Tax and Discount, Homework - Worksheet

0 Response to "43 math worksheets calculating sales tax"

Post a Comment